There are three main reasons for keeping your business records. Some states, including Texas, Illinois and North Dakota, have adopted this standard. It says businesses should keep records not covered under statute-specific retention periods for at least three years.

- We know every form you need and every deduction you can take to pay less this year.

- Knowing how long to maintain company documents, tax returns and other papers can therefore restore your peace of mind.

- Several federal agencies have document retention requirements.

- And if you have meals and lodging expenses that you report under an accountable plan for a per-diem allowance, you won’t need to keep your receipts.

If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. It does not matter if a financial record is about your profits, small business dealings, or other miscellaneous purpose; IRS can ask to produce them for audit. Therefore, you must maintain these records for a minimum of three years. Let’s look at those general categories of business documents and how long you need to keep each.

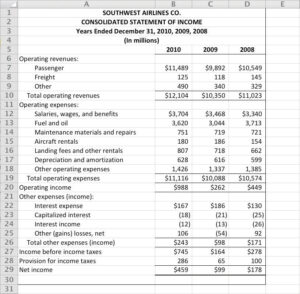

Accounting Records

Get expert advice on every topic you need as a small business owner, from the ideation stage to your eventual exit. Our articles, quick tips, infographics and how-to guides can offer entrepreneurs the most up-to-date information they need to flourish. Enrolled agents are federally licensed tax professionals who specialize in taxation and are authorized to represent taxpayers before the IRS at all levels. These laws are designed to protect workers against discrimination and unfair hiring practices. To comply, you'll need to keep hiring records on each position for at least one year from the date you made your hiring decision.

Google Executive Turnover and Role Changes Come as the ... - tech.slashdot.org

Google Executive Turnover and Role Changes Come as the ....

Posted: Tue, 22 Aug 2023 16:05:00 GMT [source]

Moreover, if IRS wishes to conduct an audit on any of your tax returns, they will do it within three years from the due date or the full payment date. In this article, we’ll look at different types of business records, why it’s important to hang onto some of them longer, and what the timeframe is for keeping them. Secure cloud storage services like Dropbox, Evernote, or Google Drive help make digital record keeping easier. The IRS isn’t the only organization with requirements on how long to keep business documents. Your creditor, lender or insurance company could also have related policies.

Types of Business Records

Your Employer Identification Number (EIN) or Tax ID Number is like a social security number. It can never be assigned to another business, and you should retain it permanently, even if you no longer operate your business. If you don't file a return at all, the IRS can come after your business at any time. If you are keeping evidence for a meal, you’ll want to have a receipt that shows the name and location of the restaurant, the number of people served, the date of the meal and the cost. Our partners cannot pay us to guarantee favorable reviews of their products or services.

There are certain documents that need to be kept indefinitely. These include your company formation documents, such as articles of incorporation (for corporations) and articles of organization (for LLCs). In addition to employee tax information, you should keep all human resources files for any employee, current or former. These records include anything like resumes, job applications and descriptions, performance reviews, and any employee files. Transactions usually generate these documents automatically.

How do I properly dispose of business tax records?

Get accurate and reliable time, location, and mileage reports. Chamber of Commerce can help your company grow and thrive in today's rapidly-evolving business environment. Connect with our team to learn how a small business membership can benefit your bottom line and help you achieve your goals.

Keep a record of the federal unemployment tax (FUTA), State Unemployment Insurance (UI) tax, and State Employment Training Tax (ETT) you paid. Hold onto your employment tax records for at least four years after you file your tax return How long should you keep business records or your pay your taxes, whichever comes first. As an employer, protect your employer identification number (EIN) and related documents. Record keeping refers to the orderly and disciplined practice of storing business records.

Nav’s Verdict: Keeping Business Records

Keep payroll records, tip reports, timesheets, dates of employment and employee benefits for at least four years. Keep your business records for seven years if you deducted the cost of bad debt or worthless securities on your tax return. Any small business that has a corporate structure also needs to retain their corporate records. These include but are not limited to articles of incorporation, bylaws, biennial reports, stock ownership, and annual meetings minutes. Digital file management systems offer many advantages, though companies must keep paper originals of some documents.

- Hopefully, this will never happen to you but if it does and you aren't prepared, you could be in trouble.

- If you find yourself in an employment tax debt problem, you may consult a professional for payroll tax relief to help you gather the right documentation for your business and employees.

- A breach of written contract is subject to a ten year statute of limitation; therefore any contracts or leases should be retained permanently.

- In addition to employee tax information, you should keep all human resources files for any employee, current or former.

According to the IRS’ record retention policy, you should keep business tax records for 3-7 years depending on the type of record and when you filed your business tax return. Use any system you like to keep books and inventory records, as long as you clearly and accurately show your gross income and expenses. Your tax records must back up all the tax deductions and credits you claim on your tax return. Keep careful track of all your income and where it comes from.

How long do I need to save business tax records?

If you have employees, you’ll want to get a clear understanding of what documentation related to hiring you need to keep. In many cases, you may need to keep a hiring file with details of the job listing and applicant information. Where your company is located and its size will determine exactly what you’ll need to keep and for how long. For example, if your company is subject to the Age Discrimination in Employment Act (ADEA), you’ll need to keep information on applicants for one year. While you’re keeping things for the IRS, don’t forget about keeping other records that are required for your business. Did you know that 1099 contractors and freelancing entrepreneurs made 36 percent of the U.S. workforce in 2019?

You can access these publications from All Publications on the California Department of Tax and Fee Administration’s (CDTFA) website. While tax time might be the most critical time for business record keeping, taxes aren't the only reason to keep these documents. Before you toss anything, double-check to see whether they're for another reason. Insurance claims or lawsuits may require records from previous events, so it's essential to review with your internal team before tossing them.

Other key ownership and business documents should be kept permanently including deeds, titles, property records, and any contracts. Maintaining accurate books and managing supporting business records is an ongoing process that will continue across your business’s lifespan. However, you don’t have to inundate your office with file cabinets and overwhelm your servers with decades of files. The IRS has set some standard retention guidelines for tax records as well as general rules for how long to keep other business records, too.

Sean O'Malley is a star - Dana White reveals new champ made UFC ... - Bloody Elbow

Sean O'Malley is a star - Dana White reveals new champ made UFC ....

Posted: Tue, 22 Aug 2023 09:08:54 GMT [source]

Here's a quick overview of handling these sorts of miscellaneous business records. At some point, you may want to close up shop and retire from small business ownership. Whether you’ve been in business only a few years or fifty, you’ve likely generated a lot of paperwork—from old tax returns to payroll records and maybe even pension statements. Depending on the type of record, you may need to keep it anywhere from 3 years to indefinitely after you’ve closed your business. The IRS isn’t always right—which is why keeping tax records is so important. Not keeping these types of records could end up putting your business in a complicated employment tax debt situation if the IRS does not believe you have paid your employment tax dues.

The guidelines may vary depending on your industry and circumstances. Your digital copies can be stored on a cloud-based storage solution. You can get started with DropBox and earn 500 MB of bonus storage space by using this link. These records can help you defend against claims or suits for compensation that occur long after your business closes. Reconciled is an award-winning organization and one of the fastest-growing accounting firms in the country.