The accounting cycle involves several steps to manage and report financial data, starting with recording transactions and ending with preparing financial statements. These entries transfer balances from temporary accounts—such as revenues, expenses, and dividends—into permanent accounts like retained earnings. A closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends) to the permanent accounts (like retained earnings). A closing entry is a journal entry made at the end of an accounting period. It involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet.

Related AccountingTools Courses

Closing entries are crucial for maintaining accurate financial records. HighRadius has a comprehensive Record to Report suite that revolutionizes your accounting processes, making them more efficient and accurate. At the core of this suite is the Financial Close Management solution, which simplifies and accelerates financial close activities, ensuring compliance and reducing errors. The trial balance is like a snapshot of your business’s financial health at a specific moment.

What is a Month-End Closing Checklist?

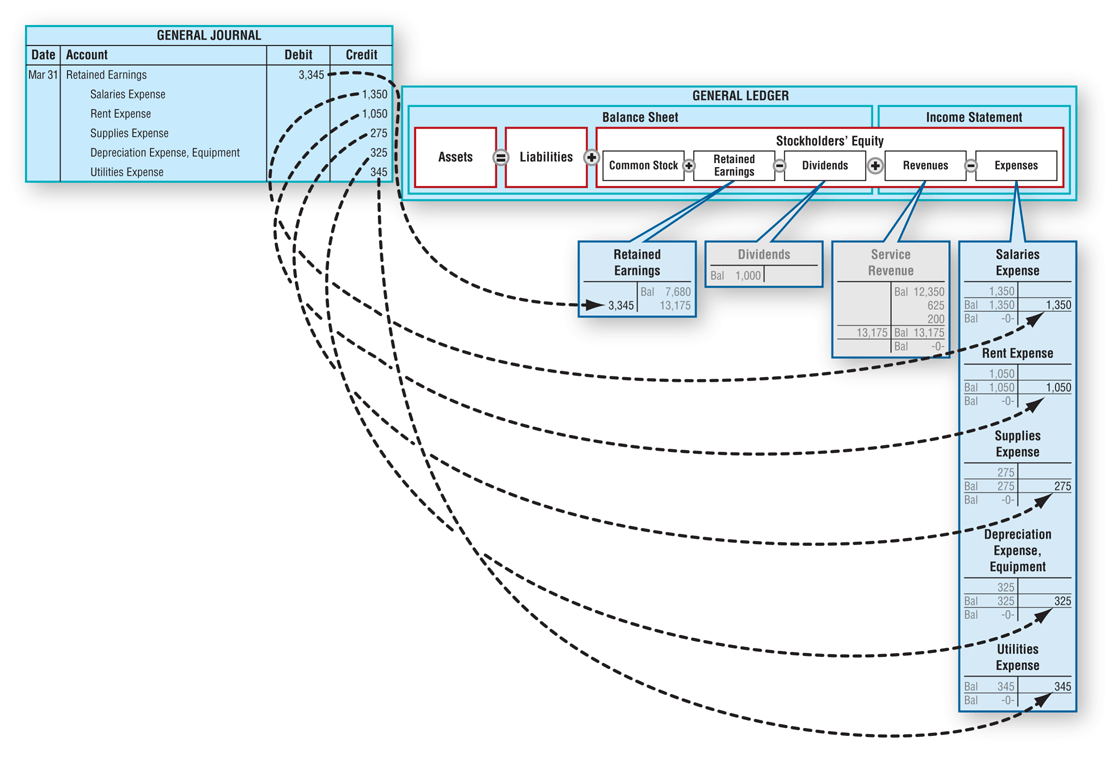

‘Total expenses‘ account is credited to record the closing entry for expense accounts. If dividends were not declared, closing entries would cease atthis point. If dividends are declared, to get a zero balance in theDividends account, the entry will show a credit to Dividends and adebit to Retained Earnings.

More Blog Posts

This module automates the creation and management of journal entries, ensuring consistency and accuracy in your financial statements. Organizations can achieve up to 95% journal posting automation with a pre-filled template, reducing errors and discrepancies and providing a reliable view of financial data. Automation transforms the process of closing entries in accounting, making it more efficient and accurate. By leveraging automated systems, businesses can ensure that all tasks related to closing entries are handled seamlessly, reducing manual effort and minimizing errors. As mentioned, one way to make closing entries is by directly closing the temporary balances to the equity or retained earnings account. Accounts are considered “temporary” when they only accumulate transactions over one single accounting period.

- Now, it’s time to close the income summary to the retained earnings (since we’re dealing with a company, not a small business or sole proprietorship).

- If both summarizeyour income in the same period, then they must be equal.

- Next, transfer the $2,500 in your expense account to your income summary account.

- And without closing expense accounts, you couldn’t compare your business expenses from period to period.

- If your revenues are greater than your expenses, you will debit your income summary account and credit your retained earnings account.

This ensures easy access to financial documents, reducing time spent searching for scattered information. Each of these steps helps in creating a clear and accurate picture of your financial standing, which is essential for strategic planning and operational efficiency. Closing the dividends or withdrawals account to Retained Earnings. You might not feel like an expert in closing entries just yet but you can always refer back to refresh your memory.

Discover essential tips to streamline your month-end close process

As a result, the temporary accounts will begin the following accounting year with zero balances. Remember, dividends are a contra stockholders’ equity account.It is contra to retained earnings. The remaining balance in Retained Earnings is$4,565 (Figure5.6). This is the same figure found on the statement ofretained earnings.

By leveraging advanced workflow management, the no-code platform, LiveCube ensures that all closing tasks are completed on time and accurately, reducing the manual effort and the risk of errors. Organizations can achieve a 40% increase in close productivity, resulting in a more streamlined financial close process and allowing your how to write an invoice - common types of invoices team to focus on more strategic activities. Now, all the temporary accounts have their respective figures allocated, showcasing the revenue the bakery has generated, the expenses it has incurred, and the dividends declared throughout the past year. Let’s investigate an example of how closing journal entries impact a trial balance.

All the temporary accounts, including revenue, expense, and dividends, have now been reset to zero. The balances from these temporary accounts have been transferred to the permanent account, retained earnings. After preparing the closing entries above, Service Revenue will now be zero. The expense accounts and withdrawal account will now also be zero.

Once we have made the adjusting entries for the entire accounting year, we have obtained the adjusted trial balance, which reflects an accurate and fair view of the bakery’s financial position. Any account listed on the balance sheet is a permanent account, barring paid dividends. On the balance sheet, $75 of cash held today is still valued at $75 next year, even if it is not spent. We at Deskera offer the best accounting software for small businesses today.