Content

Prepaid expenses help businesses defer taxes to a later financial year. As per the rules of accounting, expenses can only be recorded when they are incurred. Hence, tax on an advance expense can only be deducted in the year to which it applies. Prepaid expense amortization is important for accurate financial reporting and ensures that the expense of the prepaid asset is recognized in the appropriate period, rather than all at once.

- This means that the expense is spread out over time, rather than being recognised all at once.

- As a result, closing costs are paid to the lender as a fee for processing the loan.

- Since these expenses are considered assets, they can create a tax deduction and help reduce the money you owe during filing.

- In essence, the benefits and drawbacks linked with the prepayment of an expense would be largely dependent on the specific situation.

- When you pay for a prepaid expense, the cost is recorded as an asset on your balance sheet.

- Such expenses become current liabilities on a company’s balance sheet and have to be paid off in future.

Hence, the printer ought to be noted down as an expense over the period in which its benefit has been fully realised. When the amount of a prepaid expense is immaterial, the accountant may choose What Are Prepaid Expenses? to immediately charge it to expense. Doing so is more efficient than initially recording it as an asset and then charging it to expense with multiple journal entries over a period of time.

It’s yours, free.

The amortisation of prepaid expenses may be particularly difficult for corporations that are still reliant on manual accounting protocols as this creates lots of room for human errors to surface. For instance, if an accountant forgets to document an expense or factor in a prepaid expense that has already been amortised, this may lead to inaccurate financial reporting. Consequently, such mistakes may have a significant impact on the business decisions made as well as the firm’s tax reporting accuracy.

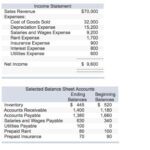

On the balance sheet, prepaid expenses are first recorded as an asset. As the benefits of the assets are realized over time, the amount is then recorded as an expense. Prepaid expenses are payments made for goods or services that will be received in the future. Instead, prepaid expenses are first recorded on the https://kelleysbookkeeping.com/ balance sheet; then, as the benefit of the prepaid expense is realized, or as the expense is incurred, it is recognized on the income statement. According to generally accepted accounting principles (GAAP), expenses should be recorded in the same accounting period as the benefit generated from the related asset.

Are Prepaid Expenses Debits or Credits

And according to GAAP (generally accepted accounting principles), when you record an expense, you must realize the benefit from the asset in the same accounting period. It’s important to establish a system for tracking and managing prepaid expenses, such as using accounting software or a spreadsheet. Regularly reviewing and reconciling accounts can also help catch any errors or discrepancies. Consulting with a CPA or financial analyst can also provide guidance and support in properly recording prepaid expenses. By accounting for prepaid insurance, businesses can manage their finances effectively, plan for future expenses, and maintain the necessary level of insurance coverage.

- The business records a prepaid expense as an asset on the balance sheet because it signifies a future benefit due to the business.

- Prepaid expenses aren’t included in the income statement per Generally Accepted Accounting Principles (GAAP).

- Prepaid expenses are common because there are many instances when it is necessary to pay for goods or services before they are received.

- As promised, here’s how to handle prepaid expenses on your financial statements.

- As you use the prepaid item, decrease your Prepaid Expense account and increase your actual Expense account.

Initially, the payment made in advance is recorded as a current asset, but the carrying balance is reduced over time on the income statement per GAAP accounting standards. Prepaid expenses are considered current assets because they are expected to be utilized for standard business operations within a year. Also, an already used portion of the prepaid expense increases the expense amount entry and decreases the total prepaid asset value. BlackLine Journal Entry is a full journal entry management system that integrates with BlackLine Account Reconciliations. It provides an automated solution for the creation, review, approval, and posting of journal entries.

Prepaid Insurance Coverage Example

” Accrued expenses are common across all lines of business, so you’ve surely come across them or had to deal with them in your business. Vendors and suppliers also benefit from the interest-free use of your company’s funds. And lastly, there’s risk involved because what if the supplier doesn’t actually deliver what they promise in the future (but you’ve already paid- i.e. a landlord can terminate your lease). Prepaid expenses cannot be deducted as they are paid because it would not be in line with the generally accepted accounting principles (GAAP). Naturally, the accuracy of financial statements cannot be overlooked, so it is of great benefit to implement a financial automation solution like SolveXia to help manage your financial data and reports. When it comes to dealing with any type of financial statements and records, financial automation solutions are here to help.

Prepaid expenses are common in most businesses and are usually tracked separately from other costs. This is because prepaid expenses are treated differently for accounting purposes than regular expenses. As we mentioned earlier, there is a difference between prepaid costs and closing costs. We already know that prepaid are upfront costs for your monthly mortgage expenses.

It’s not expensed immediately because the company has not yet benefited from the services. As future invoices come in, the company would recognize an expense and draw down the prepaid asset by the same amount. Prepaid rent—a lease payment made for a future period—is another common example of a prepaid expense. An organization makes a cash payment to the leasing company, but the rent expense has not yet been incurred, so the company must record the prepaid rent. Prepaid rent is an asset because the prepaid amount can be used in the future to reduce rent expense when incurred.

But typically, closing costs are more closely related to origination, paying title companies and closing a mortgage loan. Similar to the prepaid insurance and tax expenses, this initial escrow deposit will act as an extra cushion in your escrow account. The initial escrow deposit goes above and beyond initial prepaids and it will also continue to be held in escrow even after the first payments begin as a security precaution. If you use escrow, your mortgage insurance will be a separate prepaid cost. Prepaid insurance and taxes are two common prepaid costs included in the mortgage. Typically, 6 months to 1 full year of homeowners insurance is collected and prepaid at closing.