This guide will help you to become more familiar with the overall structure of the balance sheet. Unlike the income statement, the balance sheet does not report activities over a period of time. The balance sheet is essentially a picture a company’s recourses, debts, and ownership on a given day. This is why the balance sheet is sometimes considered less reliable or less telling of a company’s current financial performance than a profit and loss statement. Annual income statements look at performance over the course of 12 months, where as, the statement of financial position only focuses on the financial position of one day.

- Depending on the company, different parties may be responsible for preparing the balance sheet.

- It could be cash on hand, petty cash, cash deposit in the bank, or other financial note that are equivalent to cash.

- If Companies House requires it, an accountant is the best person to prepare and submit the accounts, as they will know the generally accepted accounting principles.

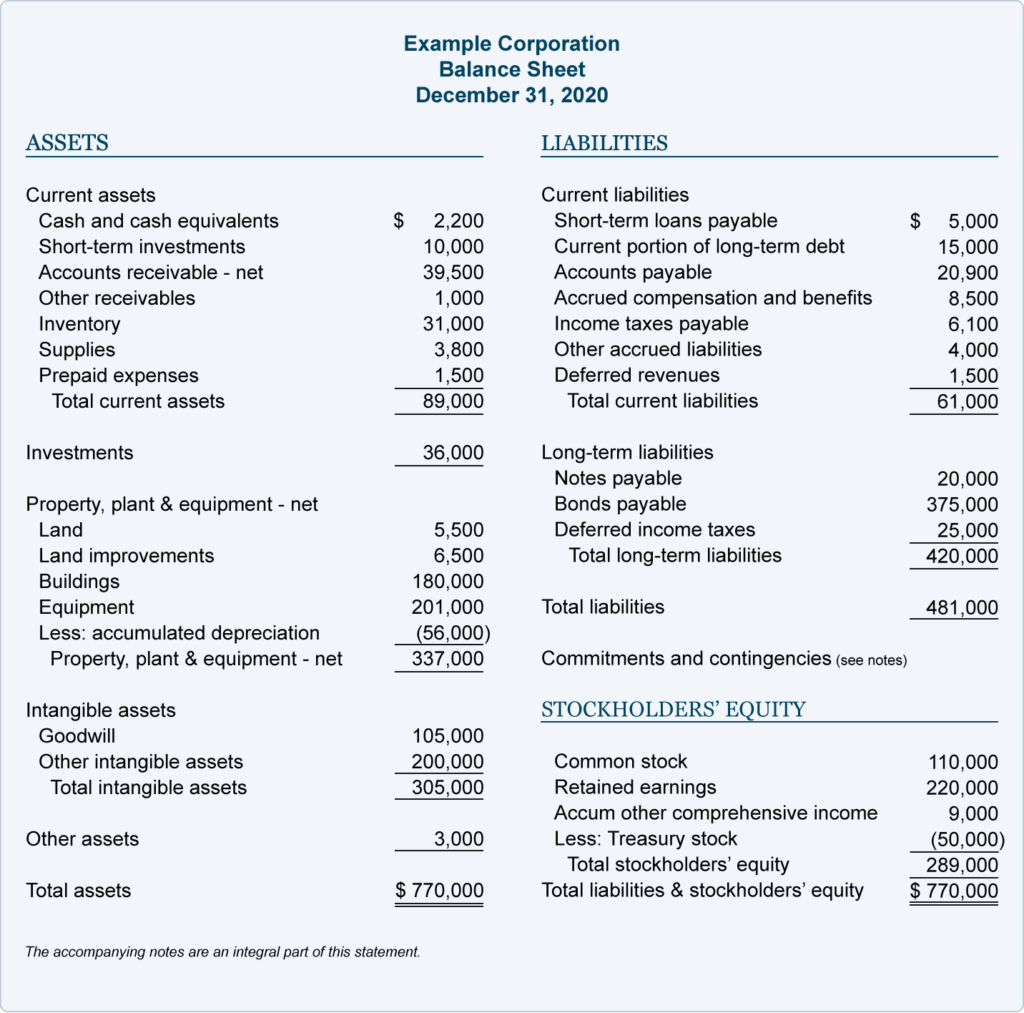

The Balance Sheet Format

External auditors, on the other hand, might use a balance sheet to ensure a company is complying with any reporting laws it’s subject to. Typically, a balance sheet will be prepared and distributed on a quarterly or monthly basis, depending on the frequency of reporting as determined by law or company policy. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan.

Balance Sheet Terms Explained

In order to get a complete understanding of the company, business owners and investors should review other financial statements, such as the income statement and cash flow statement. The balance sheet is an important financial statement as it will show a summary of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. An accounting balance sheet is a portrait of the financial standing of a business at a point in time. This financial report is similar to a personal financial statement that someone may fill out when applying for a loan to show their assets and liabilities.

Current Liabilities

A balance sheet is an important reference document for investors and stakeholders for assessing a company’s financial status. This document gives detailed information about the assets and liabilities for a given time. Using these details one can understand about company’s performance.

To judge leverage, you can compare the debts to the equity listed on your balance sheet. Leverage can also be seen as other people’s money you use to create more assets in your business. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. The ability to read and understand a balance sheet is a crucial skill for anyone involved in business, but it’s one that many people lack. Overall, a balance sheet is an important statement of your company’s financial health, and it’s important to have accurate balance sheets available regularly. When creating a balance sheet, start with two sections to make sure everything is matching up correctly.

Statement of Financial Position Template and Example:

These reports are also used to disclose the financial position and integrity of your business (i.e., the overall value of your company), which is vital for attracting investors. calculating profitability ratios Lastly, these statements are legally required to be produced and filed by public companies. Want to learn more about what’s behind the numbers on financial statements?

The NERF measures available stable resources after financing fixed assets. A negative NERF, on the other hand, suggests a potential financial risk requiring corrective measures such as a capital increase or recourse to long-term debt. The accounting balance sheet gives an overview of the company's assets, while the functional balance sheet focuses on the management and use of financial resources. The easiest way to check a balance sheet for mistakes is to see if the right side (total assets) are equal to the right side (liabilities plus owner’s equity). Long-term assets or non-current assets are assets not expected to take more than one year to be consumed or converted into cash.

Again, these should be organized into both line items and total liabilities. Shareholders’ equity reflects how much a company has left after paying its liabilities. Assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash. Balance sheets are useful tools for individual and institutional investors, as well as key stakeholders within an organization, as they show the general financial status of the company.